Commodities Trading - Gold, Silver, Crude Oil, Natural Gas and Agriculture Commodities

- Gold Prices To reach 2000 US$ per Troy Ounce in 2014

-

Gold is a buy between 1000 to 1300 USD per ounce

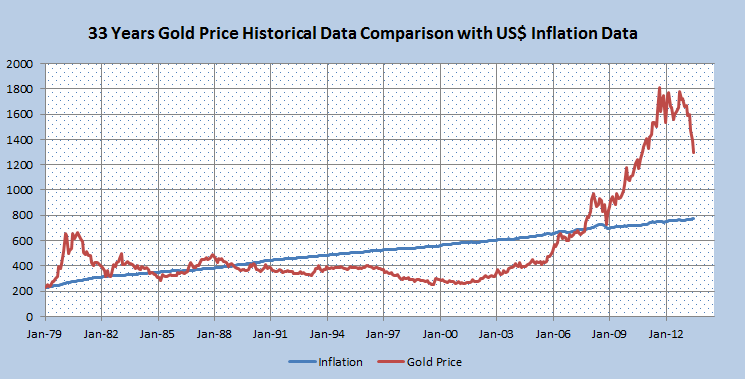

June 27, 2013 Gold Futures Closed today at 1211.60 US$. It is the price for one ounce of 24 carrot Gold. Gold Prices peaked just above 1800 US$ during Sep 2011. Today's closing price is about 30% drop from the peak. Currently the question is how much gold price can move down? For that we need to compare with the fair value of gold price compared inflation.

-

May 04, 2013 - The GLD ETF Closed at 142.09 on NYSE ARCA. It is rougly equivalient to 1420.09 US$ per one ounce of gold. It reached a high point of 174.07 on October 04, 2012. It is down by 18.41 % from the recent peak today. It did also entered into bear market territory 130.51 on April 15, 2013. This is 25% down from the recent peak.

-

Gold Price Forecast For 2013 - Gold Nearing Death Cross

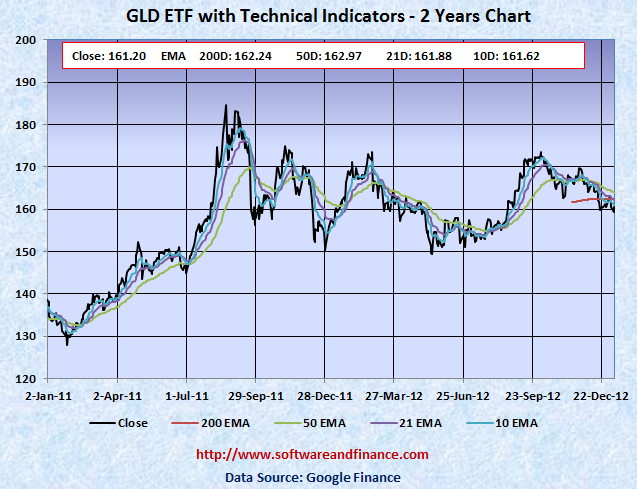

Jan 31, 2013 - The Gold ETF (GLD) closed today at 161.20. The GLD ETF is trading around it strong support level of 200 days EMA and 50 days EMA. Currently the difference between 200 days EMA (162.25) and 50 days EMA (162.97) for GLD price ETF is only in pennies. In a downward trend of gold prices, it indicates death cross for gold and it will accelerate selling pressure on gold.

- Gold Price Forecast for Year 2012

- Gold and Silver Prices Crashing While Inflation Starts!

- Gold and Silver Prices testing its 50 and 200 days EMA

- Gold and Silver Bubble to Burst in Summer 2011

- Silver ETF - Bull and Bear Funds You can find here the silver ETF investments options with silver bear and bull funds.

- Gold and Silver Prices Crashing While Inflation Starts!

- Gold and Silver Prices testing its 50 and 200 days EMA

- Gold and Silver Bubble to Burst in Summer 2011

- Oil ETFs - Bull and Bear Funds

- Natural Gas ETFs - Bull and Bear Funds

- Agriculture ETFs - Bull and Bear Funds

Gold Investments

Gold has its worst year of 2013 compared to last the decade. A simple theory is how fast it came down, the same speed it will go up. By ignoring this face, by looking at the production cost statistics from gold miners, it ranges around 1250 US$ per troy ounce. If Gold prices falls below 1200 and stays for a while, miners will suffer a great loss which in turn will reduce their production capacity. When production capacity goes down, there will be strong supply shortage of gold. Since there is strong physical and investment demand for Gold in the entire world, supply shortage will push up the price like anything which I could anticipate Gold price can reach easily 2000 US$ by end of this year in 2014.

Jan 12, 2012 - The exchange traded fund (GLD) closed today 160.38. Currently Gold prices are trading between its 200 days EMA and 50 days EMA. The convergence of 200 days EMA and 50 days EMA shows that Gold prices are stable in the last 4 months and they are most likely in the topping process.

Sep 23, 2011 - The exchange traded fund (GLD) closed today 159.80 which is about 16% down from its 52 week high of 185.85 set on Sep 06, 2011. That means with in 3 weeks, gold prices crashed by more than 16%. So far gold has been rallying for couple of months with the anticipation of inflation. When actual inflation is about to happen, gold prices started crahsing with stronger greenback.

May 29, 2011 - With reference to my earlier article on Gold Silver Burst in Summer 2011, Silver prices collapsed on first two weeks of May. The exchange traded fund SLV holding just above its 10, 21 and 50 days EMA ahead of long weekend.

May 01, 2011 - As negative sentiment towards US dollar increases, both gold and silver are currently experiencing a bubble. Gold futures trading above 1500 US$ per ounce and Silver Futures trading well above 45 in late April must burst with panic buying and short covering in US dollar.

Silver Investments

Sep 23, 2011 - The exchange traded fund (GLD) closed today 159.80 which is about 16% down from its 52 week high of 185.85 set on Sep 06, 2011. That means with in 3 weeks, gold prices crashed by more than 16%. So far gold has been rallying for couple of months with the anticipation of inflation. When actual inflation is about to happen, gold prices started crahsing with stronger greenback.

May 29, 2011 - With reference to my earlier article on Gold Silver Burst in Summer 2011, Silver prices collapsed on first two weeks of May. The exchange traded fund SLV holding just above its 10, 21 and 50 days EMA ahead of long weekend.

May 01, 2011 - As negative sentiment towards US dollar increases, both gold and silver are currently experiencing a bubble. Gold futures trading above 1500 US$ per ounce and Silver Futures trading well above 45 in late April must burst with panic buying and short covering in US dollar.

Crude Oil Investments

You can find here the oil ETF investments options with oil bear and bull funds.

Natural Gas Investments

You can find here the natural gas ETF investments options with natural gas bear and bull funds.

Agriculture Investments

You can find here the Agriculture ETF investments options with agriculture bear and bull funds.

|

|