Gold and Silver Prices Crashing While Inflation Starts!

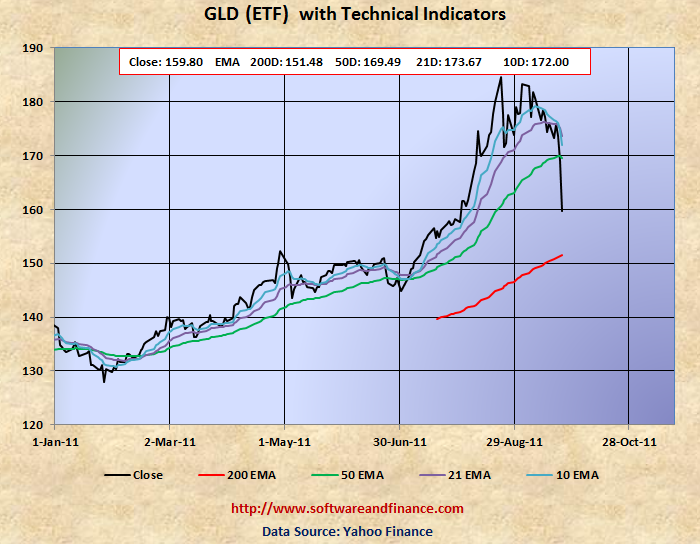

Sep 23, 2011 - The exchange traded fund (GLD) closed today 159.80 which is about 16% down from its 52 week high of 185.85 set on Sep 06, 2011. That means with in 3 weeks, gold prices crashed by more than 16%. So far gold has been rallying for couple of months with the anticipation of inflation. When actual inflation is about to happen, gold prices started crahsing with stronger greenback.

The one year chart of gold price (GLD) is given below:

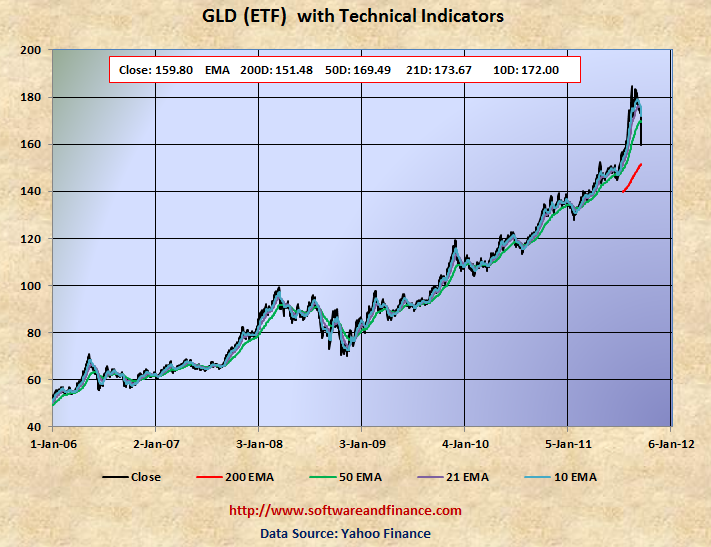

The 5 year chart of gold price (GLD) is given below:

All Item Inflation Index with one Year date (Before seasonal adjustment) for the last 3 years is given below:

Inflation from August 2010-2011 : 3.77%

Inflation from August 2009-2010 : 1.15%

Inflation from August 2008-2009 : -0.35%

Data Source: http://www.bls.gov

The gold price (GLD) on Aug 15, 2008 is US$ 77.63. The last 3 years inflation is 4.57 %. But the gold (GLD) price went up to US$ 177.72 by end of August 2011 that is 128%. It is very clear that gold prices went up 28 times more than inflation percentage. If we look at the inflation history for the last years, inflation is going to spike in the coming months with "operation twist" by Fed announcement (FOMC).

But stock market will always behave in advance. The inflation is fully priced in to gold and US$. We may not expect the gold price to go up from this. Stronger dollar and crash is gold and silver prices are more likely the outcome in the coming months.

Posted on Sep 23, 2011

|

|