Economics - Gold is a Buy between 1000 - 1300 US$ per ounce

June 27, 2013 Gold Futures Closed today at 1211.60 US$. It is the price for one ounce of 24 carrot Gold. Gold Prices peaked just above 1800 US$ during Sep 2011. Today's closing price is about 30% drop from the peak. Currently the question is how much gold price can move down? For that we need to compare with the fair value of gold price compared inflation.

Note:

1. From 1970 to 1978, Gold price per ounce traded at 35.00 US$ to 193.00 US$. In the same 8 years, inflation is about 80% where as gold prices gained 450%. These trend we have to say it is a write off. There is no way we can match 1970 inflation data with gold.

2. During Sep 1980, Gold prices peaked at 666. If we start the comparison chart Sep 1980 with the inflation data, we will see gold prices are about 30% lower than the inflation value. If we assume the inflation and gold prices are same at Sep 1980, then gold value as per inflation would be 1838.00 US$. It is also not a good comparison since we start from the previous bubble happened in Sep 1980.

Sources:

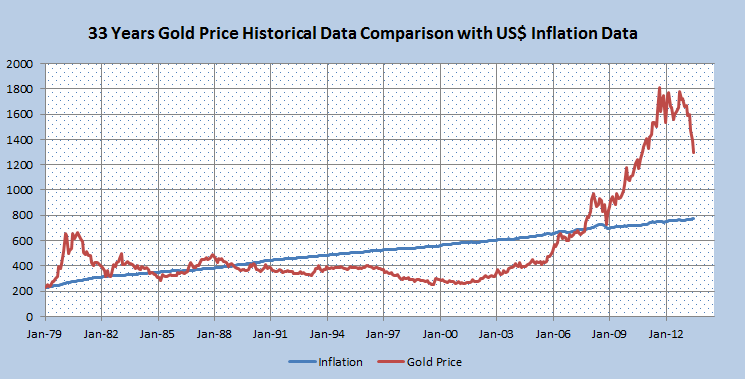

The starting point for the comparison with gold price and inflation would be from Jan 1979. Because we are going back about 18 months from the previous bubble happened on the gold price. So now we can confidently assume that the inflation and gold price are at same level in Jan 1979.

Based on the above chart, we can see that the inflation value is at 773.00 US$ and gold price is at 1292.00 as of June 20, 2013. It shows that the gold price can go down until 800.00 US$ to match with inflation. But it is very much unlikely to happen. Because of the huge demand for gold across the globe, we can see the fair value on gold price in the future. Hence we have to do some write off which we did it between 1970 - 1978. Gold has a potential to go down until 1000 but unlikely to go below 1000.00 US$ per ounce.

Right now Gold is a buy and it can also move down to 1000.00. Now the question is, why gold is a buy now? The answer is, no one knows the bottom until it happens and moves forward. If we allocate money to buy gold between 1000.00 US$ to 1300.00 US$, then we do not need to worry where the gold price bottoms since we can get the average price.

If you want to allocate 12,000 US$ to buy a gold, then you can place of the ladder of orders like below:

1. Buy Gold @ $ 1250.00 for $ 2000.00 cash value

2. Buy Gold @ $ 1200.00 for $ 2000.00 cash value

3. Buy Gold @ $ 1150.00 for $ 2000.00 cash value

4. Buy Gold @ $ 1100.00 for $ 2000.00 cash value

5. Buy Gold @ $ 1050.00 for $ 2000.00 cash value

6. Buy Gold @ $ 1000.00 for $ 2000.00 cash value

7. Unlikely to move below 1000.00 US$. Even if it does, it would be short lived for couple of minutes to days!

In this way, no matter where the gold prices bottom, you will make significant percentage of gain about 30% over a period of 12 months to 36 months.