Gold and Silver Prices testing its 50 and 200 days EMA

With reference to my earlier article on Gold Silver Burst in Summer 2011, Silver prices collapsed on first two weeks of May.

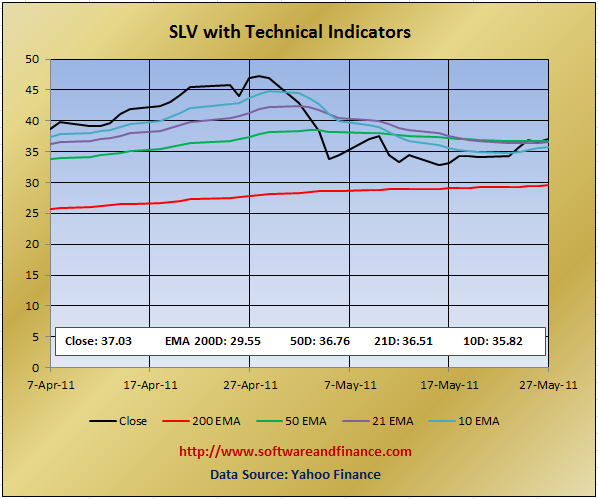

The echange traded fund SLV holding just above its 10, 21 and 50 days EMA ahead of long weekend. Look at the following chart:

Still we have not even tested its 200 days EMA atleast once in the recent correction. Still people are fond of silver and they are not accepting the silver prices can collapse. It seems they want to test whether its 50 days EMA holds or not. Currently silver prices regained its support of 50 days EMA. Again it is mark for selling point. Since we have already established the topping process, chances for silver prices going higer from the current level is very much unlikely. It will have a sharp down leg to its 200 days EMA of 29.55. Again there will be some technical buying from this point.

If we broke the 200 days EMA of 29.55, meaning silver prices going at least 10% below of 29.55, that would be 26.60, media will turn completele negative and hedge funds, speculators, momentom players will start shorting from this point. That will take the silver prices to final bottom.

Posted on May 29, 2011

|

|