Gold Price Forecast For 2013 - Gold Nearing Death Cross

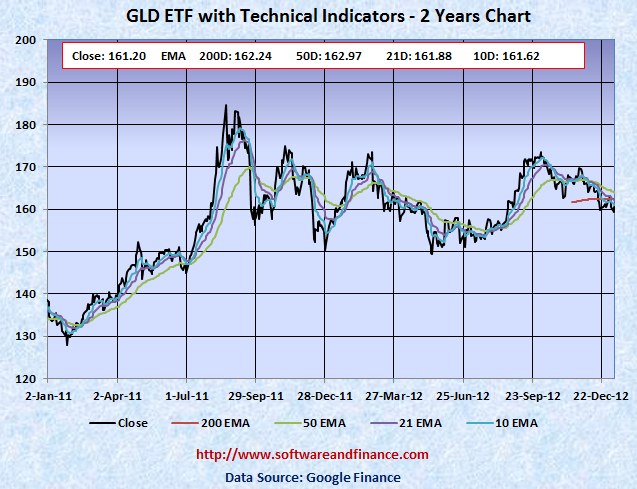

Jan 31, 2013 - The Gold ETF (GLD) closed today at 161.20. The GLD ETF is trading around it strong support level of 200 days EMA and 50 days EMA. Currently the difference between 200 days EMA (162.25) and 50 days EMA (162.97) for GLD price ETF is only in pennies. In a downward trend of gold prices, it indicates death cross for gold and it will accelerate selling pressure on gold.

The following is the two years chart of Gold Prices for GLD ETF.

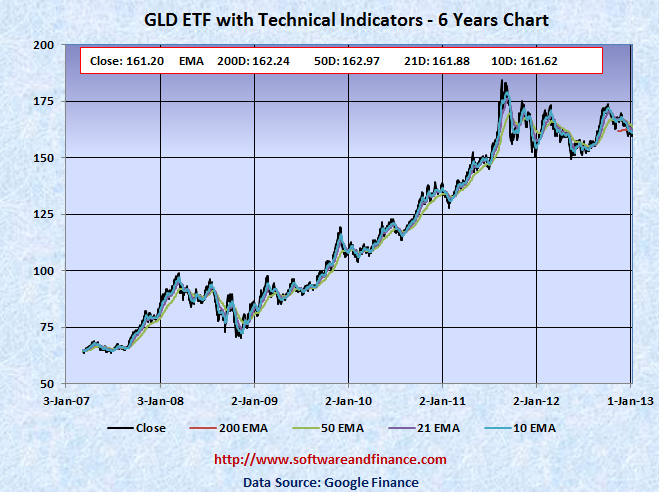

The following is the six years chart of Gold Prices for GLD ETF.

Since the US unemployment rate is roaming around 7.9% and Fed Monetary Policy May stop bond buying programme (85 billion US$ per month) may end any time during this year. And the next step is to rise the Fed Interest Rate that will accelerate panic buying in US$. So the greenback is going to enjoy a powerful rally acorss all major currencies which would also be negative for gold.

There is no suprise if USD to INR conversion rate spikes from 54.00 INR to 70.00 INR. Since Indian Market is over due for a real estate correction during this year. So by end of this year, there is a huge gold buying opprotunities if you have dollar. But unfortunately gold prices will stay stable if you hold indian currencies. The bottom line is to buy the US$ now or at least wait converting US$ to INR for couple of months, at least, Fed indicates about stopping its bond buying programme.