Nifty Technical Forecast Weekly Starting July 18, 2011 - Nifty to be in rangebound trading

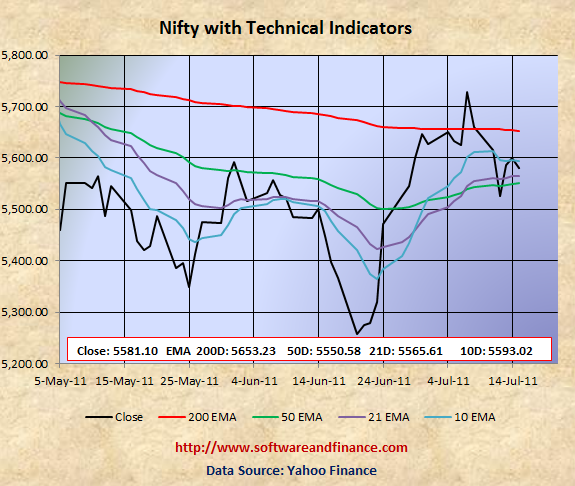

July 15, 2011 - Nifty Closed today at 5,581.10 which is about 80 points from the last week close of 5,660.65 on July 08, 2011.

With reference to last week forecast, I have mentioned that Nifty touching around 200 days EMA will force knowledgable investors to exit from the market.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Last Week Analysis

Look at the following chart. The difference between 10 days EMA, 21 days EMA and 50 days EMA are getting reduced every week informs us that market is consolidating at this point to make a big down turn.

Nifty is touching on its 200 days EMA would be a perfect time to close your existing long positions. If the market goes up for a couple of sessions, then you can initiate short position and accumulate short position gradually in the coming weeks. You can not expect return in the short term. This stratgey is good for long term risk taking investors.

If you are a long term conservative investors, then you have to switch your investment strategy and move on the Fixed Income Securities - Govt. Bonds, Fixed Deposit, etc.

Nifty is good to STRONG BUY for conservative investors only it encounters a deep correction which I expect it to go all the way down to 4800 which was set on Feb and May 2010. There might be chance for double dip in Indian Market along with world market correction. With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

For Speculators and Intraday Players

Nifty is looking for support level and looking for direction. Chances are more that Nifty will be trading in between 50 days EMA of 5550.57 and 200 days EMA of 5653.23 in this week. If you are an option player, you can consider executing butterfly options in this situation. Alternatively you can take long positions with put options for hedging. You can buy put options for long term for insurance and keep playing (buy and sell) the stocks on intraday or within a week time frame.

It is very risky to play in this market without hedging. Sudden debacle is more likely any time. Note that if we break 50 days EMA, then there is no support level for Nifty until 5225.80. There might be psychological level support of around 5400.

Technical Indicators

10 days EMA: 5593.02

21 days EMA: 5565.61

50 days EMA: 5550.58

200 days EMA: 5653.23

Next Resistance Levels:

Resistence level at: 5653.23 - 200 days EMA

Next Support Levels:

Minor support level at 5565.61 set by 21 days EMA.

Strong support level at 5550.58 set by 50 days EMA

Strong support level at 5225.80 set on Feb 10, 2011 and Jun 20, 2011

Strong support level at 4806.75 set on May 25, 2010

Strong support level at 4718.00 set on Feb 05, 2010

Strong support level at 4003.90 set on Jul 10, 2009

Strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

Strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on July 16, 2011

|

|