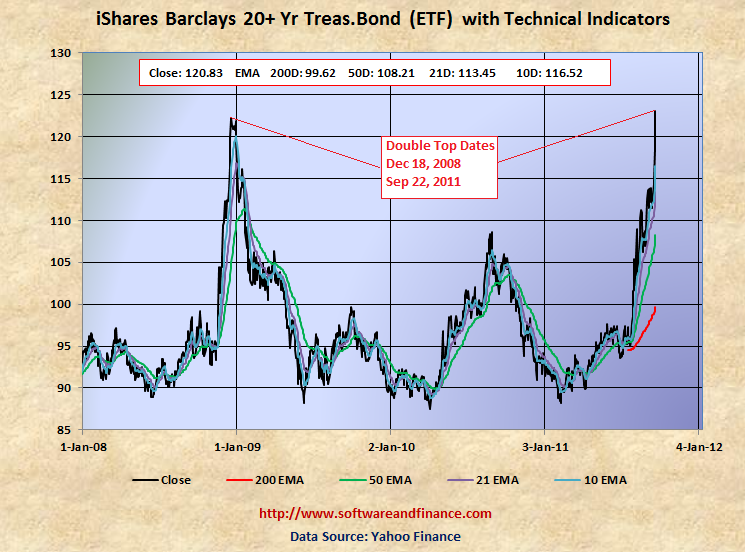

US Treasuries Double Top Signaling imminent Bear Market Rally with Market Crash in the coming months

Sep 23, 2011 TLT - iShares Barclays 20+ Yr Treas.Bond (ETF) closed today at 120.83 which is just about 3 dollars down from the annual high set on yesterday.

Double Top Event Dec 18, 2008 - Sep 23, 2011

A major double top event on US treasuries occured yesterday. We experienced a same peak at 123.15 on Dec 18, 2008.

Here are the dates along with graph.

TLT Peak at US$ 123.15 on Dec 18, 2008

TLT Peak at US$ 123.87 on Sep 22, 2011

With anticipation of QE3 and Fed plans to keep the long term rates low until spring of 2012, pushed the long term treasuries rates to lower. Front running the Fed is not a good strategy in investment. When Fed makes announcement like Fed will start buy back the US Long dated treasuries based on market condition or by mid of 2012, the treasuries prices will crash overnight. Currently Fed does not have to do anything except watching the market. Because front running the investors did the Fed job already.

|

|