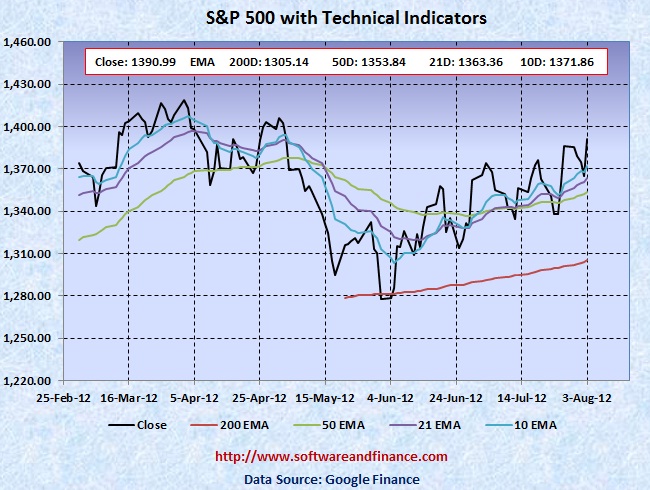

S&P 500 Forecast From August 6, 2012 - Fake Rally Will Continue? (Expected Trading Range: 1278 - 1420)

Aug 03, 2012 - S&P 500 closed today 1390.99 which is near compared to last week close of 1385.97 on July 27, 2012. S&P 500 was trading between 1354.65 and 1394.16 which is a swing of about 40 points.

To watch S&P 500 Index in google finance, visit the following link:

S&P 500 Index in Google Finance

To watch S&P 500 Index in yahoo finance, visit the following link:

S&P 500 Index in Yahoo Finance

Last Week Analysis - Unemployment Report Looks Rally Good?

US Treasuries (TLT) collapsed from last week high of 132.21 to 127.39. Since it has got no room to rally further, it triggered sell off and favored equities market. Besides the unemployment rate remains unchanged at 8.3 percent. This number really looks good. No, people got used to this number. Getting not worst is considered best to the market?

With reference to http://www.bls.gov/news.release/empsit.nr0.htm/

"Both the number of unemployed persons (12.8 million) and the unemployment rate (8.3 percent) were essentially unchanged in July. Both measures have shown little movement thus far in 2012."

Market rallied strongly following the report and also note that many traders would be on vacation during summer months.

US will hold presidential elections on Nov 06, 2012

With respect to US long term treasury prices, TLT closed today at 127.39 which is little loss for this week compared to the last week close of 128.48. However TLT reached its all time high point of 132.21 on July 25, 2012. It is the perfect time to initate short position US treasuries. The upside is very much limited on US treasuries and downside is huge.

Last Week Low: 1354.65

Last Week High: 1394.16

If you are a medium or long term conservative investors,

1. Initate short position on US treasuries.

2. Liquidate your long positions on Stocks and convert them to cash (US$)

For Speculators and Intraday Players - Bet on Volatility

CBOE Volatility Index (VIX) closed today at 15.64 today which is near flat for the week. The collapse of VIX signals that market does not have any fear and is going to make a powerful upmove. Still fundamentally the US market is very week due to unemployment and slumping house prices along with US debt downgrade. Always fundamental wins in the long run. You can consider taking long positios on VIX also.

Only if you are day trader, you can have the following options:

1. Buy 1X OTM call option and 2X OTM put option - Long Strip.

2. Long Stocks and stop loss orders

3. Long Stocks with long put options

Note: OTM - means Outside the money.

Technical Indicators

Next Resistance Levels:

strong resistance level at: 1400 - crazy market move

strong resistance level at: 1345.02 set by Jul 22, 2011.

strong resistance level at: 1348.24 set by 50 days EMA.

strong resistance level at: 1386.95 set on Mar 16, 2007

strong resistance level at: 1433.06 set on Aug 03, 2007

strong resistance level at: 1440.70 set on Nov 23, 2007

strong resistance level at: 1453.55 set on Sep 07, 2007

strong resistance level at: 1,530.23 set on May 30, 2007 (first closing high after dot com bubble)

strong resistance level at: 1,552.87 set on Mar 24, 2000 (all time high during dot com bubble)

strong resistance level at: 1,565.15 set on Oct 09, 2007 (all time high during housing buble before sub prime crisis)

Next Support Levels:

strong support level at: 1305.14 set by 200 Days EMA.

strong support level at 1189.40 set on Nov 26, 2010

strong support level at 1119.46 set on Aug 08, 2011

minor support level at 1064.59 set on Aug 27, 2010

strong support level at 1022.58 set on Jul 02, 2010

strong support level at 1036.18 set on Oct 30, 2009

strong support level at 946.21 set on Jun 12, 2009

strong support level at 827.37 set on Sep 27, 2002

strong support level at 683.38 set on Mar 06, 2009

strong support level at 638.73 set on Jul 19, 1996 - Might see this number again when completing double dip bottom

Posted on Aug 05, 2012

|

|