S&P 500 Forecast From Oct 03, 2011 - Market to retest its next support level 1036 ?

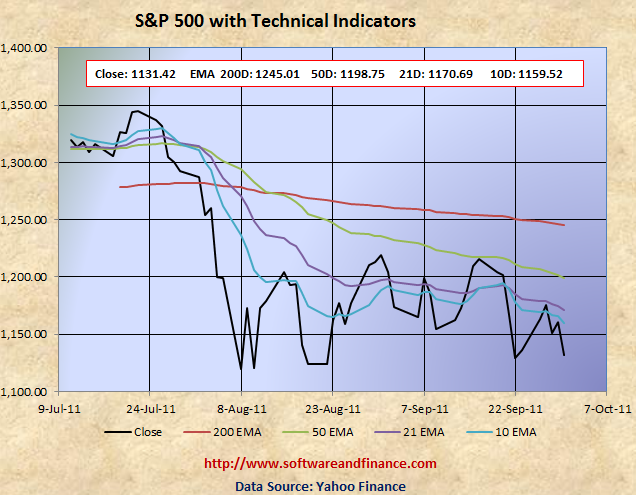

Sep 30, 2011 - S&P 500 closed today at 1131.42 which is almost flat compared to last week close of 1136.43 on Sep 23, 2011. S&P 500 experienced a swing of about 65 points between 1131.07 and 1195.86 in the last week.

To watch S&P 500 Index in google finance, visit the following link:

S&P 500 Index in Google Finance

To watch S&P 500 Index in yahoo finance, visit the following link:

S&P 500 Index in Yahoo Finance

Last Week Analysis - Bear Market Rally and and banking sector turbulence

S&P 500 experienced a swing of about 65 points between 1131.07 and 1195.86 in the last week.

Last Week Low: 1131.07

Last Week High: 1195.86

We had a bear market rally in the begining of the week, renewed euro zone fears and poor performance from banking sector pushed the index towards south as week progress.

If you are a long term conservative investors, it is the time to liquidate all of your long position US treasuriesand consider shorting US Treasuries gradually in the coming weeks with a ladder of order.

The collapse in US Treasury prices are inevitable since even with QE3, Fed will start buying only when the treasury prices are low and front running the Fed is not a good strategy in investment.

Currently dollar is the only safe heaven for long term conservative investors.

For Speculators and Intraday Players - Market may retest its next support level

The debt talks, earning season and on going crisis from Euro Zone increased the volatility. Still fundamentally the US market is very week due to unemployment and slumping house prices along with US debt downgrade. Always fundamental wins in the long run.

As we retested this support level 1100+ a couple of times, it is most likely the bears will control the market in the coming weeks to take it below 1100 that would be 1036.19 set on Oct 30, 2009.

Only if you are day trader, you can have the two following options:

1. Buy 1X times of (OTM) call options and 1X time of (OTM) put option - known as option strangle.

2. Buy 1X time of call and 1X time of put option with the same strike price - known as option straddle.

Note: OTM - means Outside the money.

Technical Indicators

10 Days EMA: 1170.82

21 Days EMA: 1180.43

50 Days EMA: 1208.30

200 Days EMA: 1248.15

Next Resistance Levels:

strong resistance level at: 1248.15 set by 200 days EMA

strong resistance level at: 1386.95 set on Mar 16, 2007

strong resistance level at: 1433.06 set on Aug 03, 2007

strong resistance level at: 1440.70 set on Nov 23, 2007

strong resistance level at: 1453.55 set on Sep 07, 2007

strong resistance level at: 1,530.23 set on May 30, 2007 (first closing high after dot com bubble)

strong resistance level at: 1,552.87 set on Mar 24, 2000 (all time high during dot com bubble)

strong resistance level at: 1,565.15 set on Oct 09, 2007 (all time high during housing buble before sub prime crisis)

Next Support Levels:

strong support level at 1119.46 set on Aug 08, 2011

strong support level at 1189.40 set on Nov 26, 2010

minor support level at 1064.59 set on Aug 27, 2010

strong support level at 1022.58 set on Jul 02, 2010

strong support level at 1036.18 set on Oct 30, 2009

strong support level at 946.21 set on Jun 12, 2009

strong support level at 827.37 set on Sep 27, 2002

strong support level at 683.38 set on Mar 06, 2009

strong support level at 638.73 set on Jul 19, 1996 - Might see this number again when completing double dip bottom

Posted on Oct 01, 2011

|

|