Netflix (NFLX) - How to play Netflix earnings on Jul 25, 2011

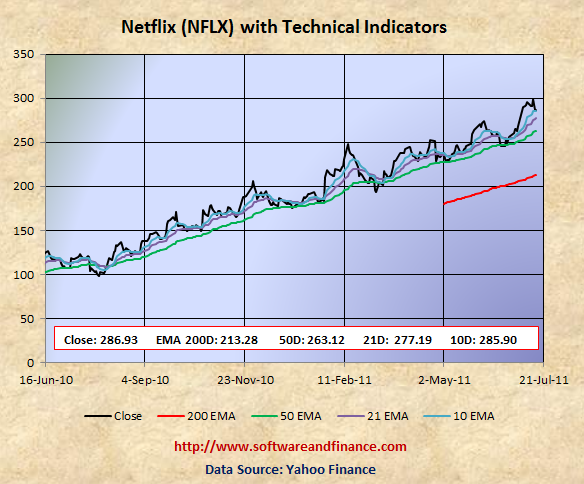

July 15, 2011 - Netflix (NFLX) closed today at $286.93 which is down by $17.86 from its annual high of 304.79. With the streaming service, no doubt that Netflix will post strong earnings in this quarter and the coming quarters. This is known to everyone and that why we see the strong bull run with NFLX in the recent past.

But the share price of close to $200 is worth compared to the earnings and book value? No, The earnings are already priced into the shares. Psychologically even NFLX comes up with good earning, chances are more than share price will go down. Even if they surprise the market with very good numbers and share prices, the rally will continue for a day or two and then it will start to go down.

Now we can see how to play to Netflix with its earning!

Create option strip with August 20 - (1X) Call and (2X) Put options

Here is the one year chart of Netflix. If you see the technicals, it clearly shows market is very bullish on Nextflix. Options are always very high risky and it may not be suitable for all kinds of investors.

The earnings will come out on Monday July 25 after the market close. So it is a good idea to trade with August 20 call and put options.

As there is no short dated weekly options available for NFLX, we have to go with August 20 call and put options. In case NFLX shares are trading around $ 300 on Monday July 25th, You can consider creating an option strip below:

1 contract - August 20 expiry Call Option Strike Price 310.00

2 contracts - August 20 expiry Put Option Strike Price 290.00

You can increase the quantity based on your risk tolerance.

Technical Indicators

10 Days EMA 285.90

21 Days EMA 277.19

50 Days EMA 263.12

200 Days EMA 213.28

Posted on July 16, 2011

|

|