Stock Market - Watch out ETFs with short term futures

This topic is about trading ETF that follows the short term futures. We can take UNG as an example. UNG is a fund of Natural Gas Futures traded in NYMEX. It has got only the near month futures contracts and the fund rolls over to next month on the specified dates. You can find more details about this fund on their website http://www.unitedstatesnaturalgasfund.com/.

The ETFs with short term future contracts are good as long as there is no super contango. In this case, there is significant percentage getting wiped out because of rolling over the contract from near month to next month, we need to be careful. It becomes highly speculative ETFs rather than holding for a long term beacuse of short term futures. UNG is one of the biggest loser in the last two years. It is down by 25% only in 2010 and it is down by 88% since it's high on first week of July 2008.

The reason why UNG has significant percentage is not only the effect of contango. It started acting as closed-end ETF from 3rd week August 2009 because of government regulation on limiting the positions. But there was a huge investment demand for this ETF. As this fund unable to issue more shares because of regulation, it started acting as a closed-end ETF with huge premium. When the natural gas prices recovered, UNG could not gain but simply its preminum got wiped out.

If we have an ETF with average of 3 months or 6 months future contract prices, then it would have saved lot of money on rolling over the cost. Of course, if there is a huge rally in the near month contract, these ETFS would not have full impact on gains. But it is safe to play.

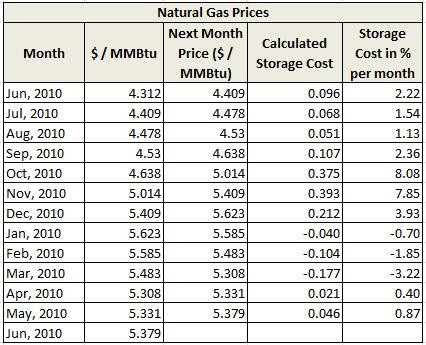

The table shows the natural gas future prices as of May 14, 2010 traded in New York Mercantile Exchange (NYMEX).

The table shows the current value of Natural Gas Futures prices and its contango effect. Why contango occurs? One major reason is the associated storage cost and there is no convenience yield. The storage cost would be more in case of natural gas, I have roughly calculated the storage cost for each month per MMBtu. If the producers can reduce the storage cost compared to the calculated value in the above table, then arbitrators will jump in to make free money by long on short term future and short on long term future contract.

In case of Gold, it is easy to store and it has got the convenience yield also. The price difference in Gold Futures between the current month and after one year is just 0.78%. In case of natural gas, the price difference is around 25% for the same duration.

|

|