India - Inflation to create housing bubble and deflation to burst

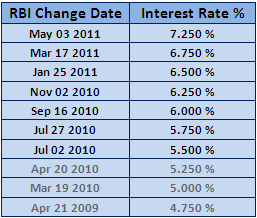

In Oct 2008 RBI Interest rate was set at 9.0% and the inflation was around 6.0% at the time. To accelerate the growth, RBI slashed the interest rate like anything almost 50% in 6 months time frame. In April 2009, RBI set the interest rate at 4.75%. It triggered the inflation like anything and also created a credit bubble. In 2009-2010, Inflation was its highest level in the last 15 years crossed more than 12.00%. From March 2010, RBI has started really worrying about the inflation rate and started rising the interest rate to tackle the inflation. Currently the interest rate is at 7.25% and inflation came down to 8.00% from double digit.

Inflation is to create Housing Bubble?

Keeping the key interest rate row accelerates the growth and by following this strategy would help for growth, no doubt. But the problem keeping the interest rate low often creates bubble – let it be credit bubble or housing bubble. If the interest rate was low, many middle class income people buy homes at floating interest rate as it can be afforded for them and hence creates artificial demand in the housing market. As long as the interest rates keep going down, the sellers take advantage of the low interest rate to increase the price and hence the housing bubble was created in India.

Deflation to burst the housing bubble in India

Now the pain is with the home owners paying mortgages monthly payment would start going high every year as the interest rate is getting increased consistently. Look at the following chart and you can see that the people paying floating interest rate are supposed to pay 2.5% interest more on top of their mortgage. Refinancing would also be very expensive for them.

If the interest rate goes up to near double digit, many people would start consider selling their homes mainly for two reasons:

- Their monthly mortgage payment gone up very high, in some cases, 50% more than from their initial monthly payment.

- Increasing the rates often discourages the new buyers. Consequently the demand for housing would go down along with dampening the home price. Home owners would also start worrying about their home values are going down by wiping out their existing home equity.

Along with these problems, in case, unemployment goes up, housing prices will collapse by going down at least 30% by bursting the housing bubble that has already created in India.

RBI would be in a very difficult situation to tackle inflation and growth. Once the housing burst happens, it will simultaneously bring deflation and vice versa.

Wait for RBI next move to see where housing prices in India are are heading to? From my opinion, housing prices in India will keep falling in the coming years. It is the excellent time for sellers and they have very short time to sell as housing market correction is imminent. Buyers can relax and wait for more time on watching the market move.

Posted on May 22, 2011

|

|