Credit Bubble With Federal Funds Rate

May 31, 2011 currently we have a credit bubble in market since federal funds rate have been near zero since December 2008 that is around two and half years.

By keeping the interest rate low for the last two and years It would have created a credit bubble in the market since banks are able to borrow billions of dollar with close the zero percent interest rate and lending to credit card customers for more than 10% - 30% interest rate, banks are able to make enormous profit. As the interest rate is low, banks can easily make money by taking the tail end risk which is good as long as the interest rate stays low.

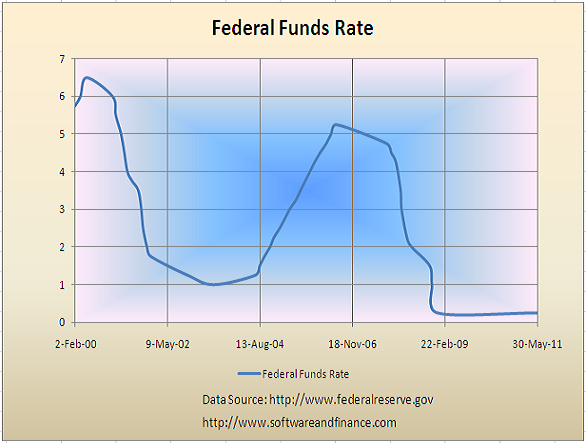

Look at the following chart. By keeping the interest low, that is less than or equal to 2% from November 2001 to November 2004 which is about 3 years created the housing bubble.

To solve the housing price collapse, again fed is keeping the interest rate near zero which is less than the earlier time period (Nov 2001 - Nov 2004). Now it created a credit bubble.

Credit bubble will burst in this winter season (Dec 2011 - Feb 2012)

Historically if you compare to the recent past which is after 2000, fed was able to keep the interest rate less than 2% for 3 years. Currently the near zero percent interest rate is there since December 2008. If we count 3 years from December 2008, that would be December 2011. Chances are higher that Fed may start rising the interest rate from near zero percent from end of this year. That would trigger the collapse of credit bubble or that would be the beginning point for the collapse of credit bubble. This collapse of credit bubble would take around 12-18 months.

Note that even Feb started rising interest rate from Nov 2004, housing prices continue to climb for 18 months. Now it would be reverse scenario. Housing prices will continue to collapse when the Fed started rising the rate once again. Once Fed is increasing the rate, both housing and credit bubble-burst will see the final bottom after 12-18 months. This is a high level estimate and chances are higher the housing prices might see the final bottom before the presidential election of 2012.

Posted on May 31, 2011

|

|