Personal Finance - Estimating your 2010 Federal Incomes Taxes in USA

I have written this article to understand how much you pay on taxes in USA on each federal bracket.

Refer to http://www.moneybluebook.com/2010-federal-income-tax-brackets-irs-tax-rates/ to view the tax bracket table.

If you look the federal income tax bracket for year 2010, there would be big jump 10% increase between 15% and 25%. If your filing status is married filing jointly, then you have to pay 25% taxes for the amount you make more than $68,000 of AGI (Adjusted Gross Income). If your AGI is $75,000, then you have to pay 25% for the portion $7000 ($75,000 - $68000). You can increase your 401 K savings or traditional IRA contribution up to $7000 to avoid 25% tax.

Even if you make more than $150,000 per annum, then contributing to traditional IRA will help to reduce your tax burden. However still you will have lot of money left with 25% tax bracket.

But if you make around $100,000 per annum, then you can make yourself to be in 15% tax bracket at maximum.

Click here to download the USA - Income Tax Estimator for Year 2010.

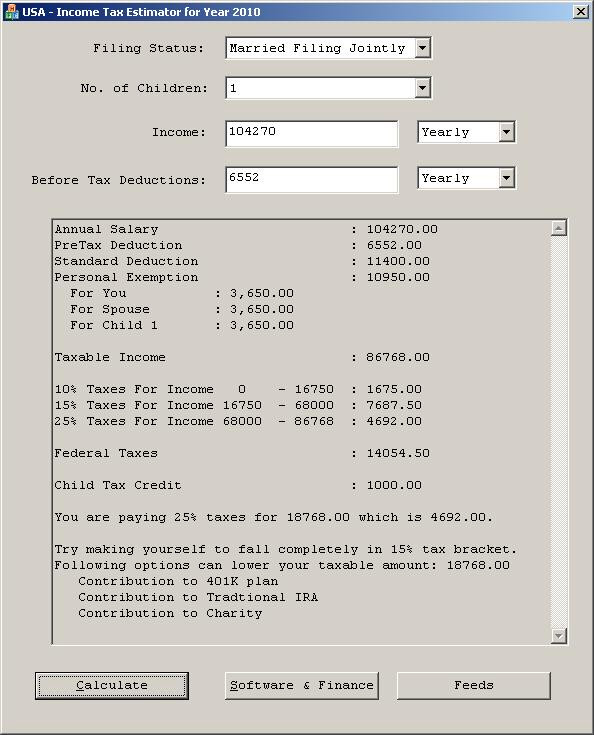

Case 1 Average Income

If a person makes around $104K per annum in this example. He is getting $1000 as child tax credit as his adjust gross income before applying standard deduction and personal exemption is less than $110K. He is supposed pay 25% taxes as $4692 for the money he made beyond 68,000 which is $18768. As there is a significant increase 10% from 15% to 25%, he can consider lowering this amount by increasing his contribution on 401K or contributing to traditional IRA. Both he and his spouse are eligible to contribute $5000 each on tradtioanl IRA. Consequently contributing $10,000 to tradtional IRA will lower his income tax by 25% which is $2500. He can also include child day care expenses,interest paid to mortgage and contribution to charitible organization as a part of itemized deductions.

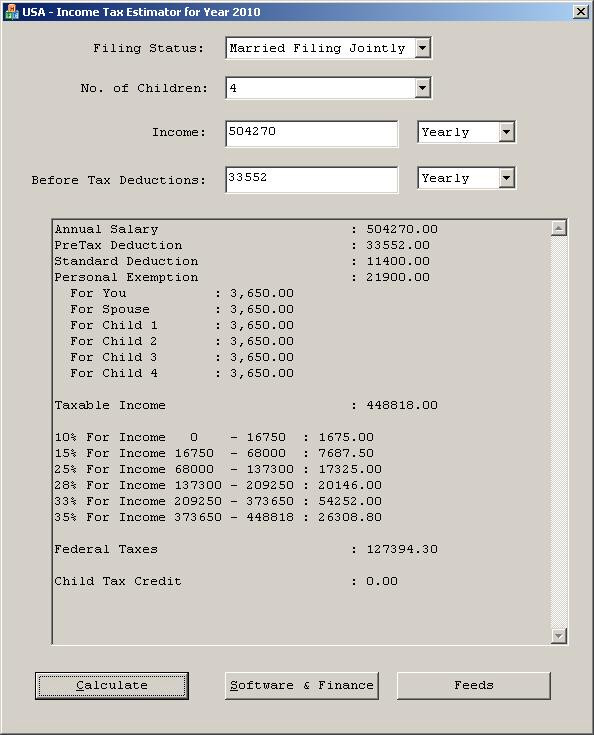

Case 2 High Income

If a person makes more than 500K has to pay more taxes and no child tax credit. Contributing to tradtional IRA might lower income taxes. Income range is very high, he is not going to get affected with paying taxes.

|

|