Nifty Weekly Forecast From Oct 22, 2012 - Nifty to follow US Market! (Expected Trading Range: 5180 - 6000)

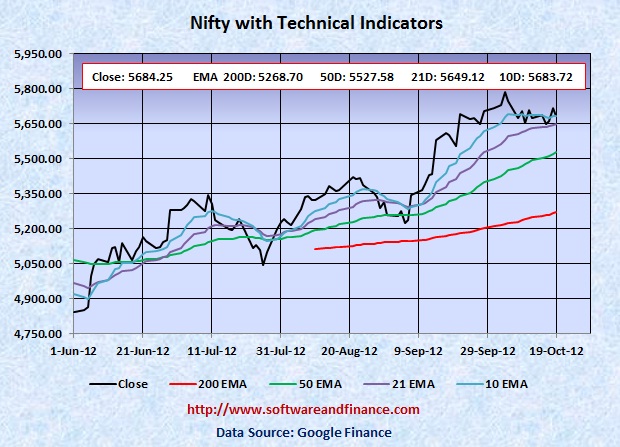

Oct 19, 2012 - Nifty closed today at 5684.25 which is about 8 points up from the last week close of 5676.05 on Oct 12, 2012. Nifty was trading between 5633.90 and 5722.50 that is the swing of about 89 points.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Last Week Analysis - Google Earning Shows the Reality

No matter what, Fed has already created the credit bubble by keeping the interest rate low for about 4 years. And this credit bubble will burst; this is going to be a very surprise and another disaster to the economy. The american workforce dropped to the lowest level in 31 years. Market is getting ready to crash! But the only question is whether it will happen immediately before or immediately after the US presidential election. Porlonged rate cuts helped to create new Jobs and reduce the unemployment news. Which in turn becomes negative on increasing the interest rate that is not positive for the market. In another look, market will not care about increasing the interest rate.

The big suprise news for the market is the premature earning release from Google during the market hours which turned the GOOG stock trading to halt for the rest of the day. Google earnings was a big surprise to the market since they also face same problem with theirs ads on mobile. Due to the increasing mobile users, mobile content does not have enough space to display the ad units as in PCs.

US will hold presidential elections on Nov 06, 2012

With respect to US long term treasury prices, TLT closed today at 121.71 which is a another slump from the last week close of 123.97. TLT reached its all time high point of 132.21 on July 25, 2012. In the short time, TLT may make a siginificant upward move. So if you are trading on US treasuries in the short term, it is a good time to take long position on US treasuries.

Last Week Low: 5633.90

Last Week High: 5722.50

Not Safe to hold your long positions on Nifty

Nifty trading well above its 200 days EMA, is considered as an exit point for your long position on equities. It may continue its bull run but it does not promise anything. If you are conservative investors, hold currency or indian T-Bills. You can take long positions on Nifty between 4000 and 4500.

Nifty might experience a double dip in Indian Market along with world market correction in the long term (about one and half years). With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

For Speculators and Intraday Players - Bet On Volatility

CBOE Volatility Index (VIX) closed today at 17.06 which a another recovery from the last week close of 16.14. Now the market is showing some fear compared to the earlier weeks, but still VIX is going to make a powerful upmove Since fundamentally the US market is very week due to unemployment and slumping house prices along with US debt downgrade. Always fundamental wins in the long run. You can consider taking long positios on VIX also.

Only if you are day trader, you can have the following options:

1. Buy 1X OTM call option and 2X OTM put option - Long Strip.

2. Long Stocks and stop loss orders

3. Long Stocks with long put options

Note: OTM - means Outside the money.

Technical Indicators

Next Resistance Levels:

Strong Resistence level at: 6312.45 on Nov 05, 2010

Psychological Resistence Level at: 6000.00

Strong Resistence level at: 5360.70 - Set on Oct 28, 2011

Strong Resistence level at: 5633.95 - Set on Jul 22, 2011

Strong Resistence level at: 5884.70 - Set on Apr 28, 2011

Strong Resistence level at: 6134.50 - Set on Dec 31, 2010

Strong Resistence level at: 6274.30 - Set on Jan 04, 2008

Strong Resistence level at: 6312.45 - Set on Nov 05, 2010 (Double Top of Jan 04, 2008)

Next Support Levels:

Strong Support level at: 5527.58 Set by 50 days EMA

Strong Support level at: 5268.70 Set by 200 days EMA

Psychological Support Level at: 5000.00

Strong support level at 4835.65 set on May 23, 2012

Strong support level at 4718.00 set on Feb 05, 2010

Strong support level at 4639.10 set on Nov 24, 2011

Minor Support level at 4531.15 set on Dec 20, 2011

Strong support level at 4003.90 set on Jul 10, 2009

Strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

Strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on Oct 19, 2012

|

|