Nifty Weekly Forecast From March 26, 2012 - Indian Markets Continuing sell off for 5th consecutive week! (Expected Trading Range: 5078 - 5336)

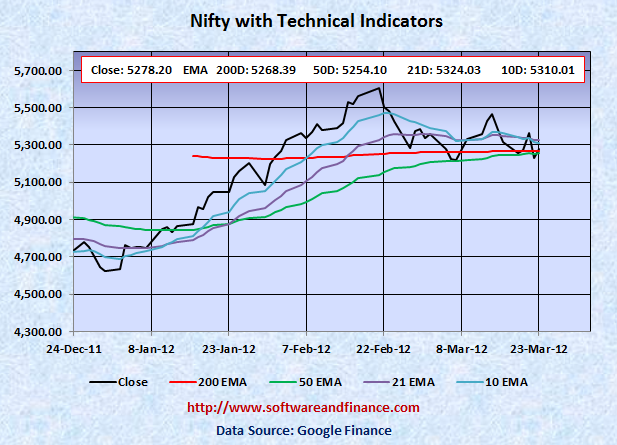

Mar 23, 2012 - Nifty closed today at 5278.20 which is about 39 points down (0.73%) from the last week close of 5317.90 on Mar 16, 2012. Nifty was trading between 5,220.00 and 5,385.95 that is the swing of 166 points. Note that Nifty was up by about 14% year to date in 2012 and this week logs the 5th consecutive weekly loss on year 2012.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Last Week Analysis - Nifty was down for 5th consecutive week

Nifty was down by 0.73% for the last week and still it was up by 14% for year to date. For the last 5 weeks, Nifty was trading in negative territory and currently emerging markets are leading the developed countries. Disappointing New Home Sales data from US signals that worst is about to start.

Interest rate have been going up will potentially damage the home buyer's interest. Rising interest rate and dollar will become another serious problem to the economy, especially to the tech sector. Nasdaq trading above 3000 points is a clear bubble. Rising dollar will potentially decrease the earning of technology sector since they are export based companies.

I have been mentioning that greedy investors will not hesitate to stop betting until Nasdaq reaches 3,000.00, Dow Jones reaches 13,000.00 and S&P 500 reaches 1,400.00 in the last couple of weeks. It is nothing but to touch the fancy number before it moves down significantly and this is the time when the Nasdaq Tech bubble will burst. Currently all indicies have crossed the upper bound.

Oil prices have been gone up so fast in the last 6 months. During election year, oil prices will be trading at low levels historically due to polictial interest. Besides rising dollar is the key factor now. Market bottom will be seen around election that is where when everything goes down except US$.

FYI - France will hold presidential elections on April 22 and May 6, followed by general elections in June.

US will hold presidential elections on Nov 06, 2012.

With respect to US long term treasury prices, TLT closed today at 113.18 which is about 1.5% up for the week compared to last week close of 111.43. US treasury is a good buy now since it touched and trading around its 200 days EMA of 110.00. But if you are short on US treasuries, you have to liquidate your short position. US treasuries (Ticker: TLT) TLT upside is huge now that is towards 125-130.

Last Week Low: 5220.00

Last Week High: 5385.95

It is time to liquidate all of your long positions on Nifty and create new short position. We do not have any history of running into bull market crossing over 200 days EMA in one shot. It has to go through a couple of retesting. Still market has to go through lots of bad news from Euro Zone, downgrades, unemployment, etc.

If you are conservative investors, hold currency or indian T-Bills rather than creating short position on Nifty. You can take long positions on Nifty between 4000 and 4500.

Nifty might experience a double dip in Indian Market along with world market correction in the long term (about one and half years). With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

For Speculators and Intraday Players - Options Strip

1. Buy 2X OTM put option and 1X OTM call option - Options Strip.

2. Short Stocks and stop loss orders.

3. Short Stocks with long call options

Note: OTM - means Outside the money.

Technical Indicators

10 days EMA: 5310.01

21 days EMA: 5324.03

50 days EMA: 5254.10

200 days EMA: 5268.39

Next Resistance Levels:

Strong Resistence level at: 5360.70 - Set on Oct 28, 2011

Strong Resistence level at: 5633.95 - Set on Jul 22, 2011

Strong Resistence level at: 5884.70 - Set on Apr 28, 2011

Strong Resistence level at: 6134.50 - Set on Dec 31, 2010

Strong Resistence level at: 6274.30 - Set on Jan 04, 2008

Strong Resistence level at: 6312.45 - Set on Nov 05, 2010 (Double Top of Jan 04, 2008)

Next Support Levels:

Minor support level at 5268.39 set by 200 days EMA

Minor support level at 5254.10 set by 50 days EMA

Strong support level at 4718.00 set on Feb 05, 2010

Strong support level at 4639.10 set on Nov 24, 2011

Minor Support level at 4531.15 set on Dec 20, 2011

Strong support level at 4003.90 set on Jul 10, 2009

Strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

Strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on Mar 24, 2012

|

|