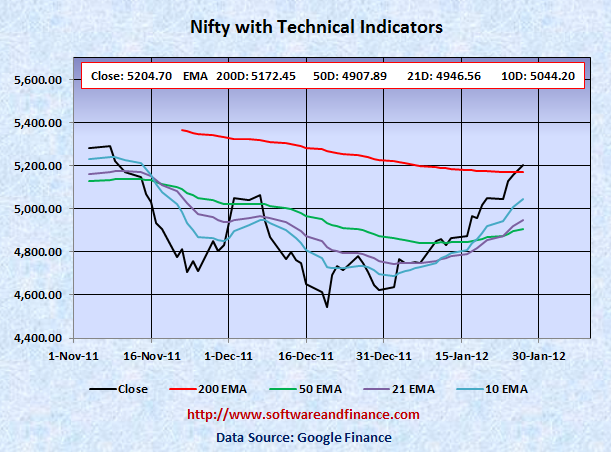

Nifty Weekly Forecast From Jan 30, 2012 - Nifty will fail to hold 200 days EMA? (Expected Trading Range: 4868 - 5232)

Jan 27, 2012 - Nifty closed today at 5204.70 which is about 156 points up (3.09%) from the last week close of 5048.60 on Jan 20, 2012. Nifty was trading between 5021.35 - 5217.00 which is about the swing of 196 points.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Last Week Analysis - Nifty Regained its 200 days EMA

Nifty was up by 3.09% for the last week and was up by 12.55% for year to date.

FYI - France will hold presidential elections on April 22 and May 6, followed by general elections in June.

US will hold presidential elections on Nov 06, 2012.

RBI move on cutting the cash reserve ratio to 5.5% from 6% triggered a huge rally in the market. The rally is also due to short covering also. This pushed the Nifty index just above its 200 days EMA of 5172.45. It is the time to exit from the market and create new short positions on Nifty.

With respect to US long term treasury prices, TLT closed today at 118.10 which a gain of about 1% for the week compared to last week close of 116.98. US treasury is now too late to short and too early to buy. US treasuries (Ticker: TLT) would bottom near 100 - 103 and TLT upside would be maximum of 125-130.

Last Week Low: 5021.35

Last Week High: 5217.00

It is time to liquidate all of your long positions on Nifty and create new short position. We do not have any history of running into bull market crossing over 200 days EMA in one shot. It has to go through a couple of retesting. Still market has to go through lots of bad news from Euro Zone, downgrades, unemployment, etc.

If you are conservative investors, hold currency or indian T-Bills rather than creating short position on Nifty. You can take long positions on Nifty between 4000 and 4500.

Nifty might experience a double dip in Indian Market along with world market correction in the long term (about one and half years). With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

For Speculators and Intraday Players - Options Strip

1. Buy 2X OTM put option and 1X OTM call option - Options Strip.

2. Short Stocks and stop loss orders.

3. Short Stocks with long call options

Note: OTM - means Outside the money.

Technical Indicators

10 days EMA: 5044.20

21 days EMA: 4946.55

50 days EMA: 4907.89

200 days EMA: 5172.45

Next Resistance Levels:

Strong Resistence level at: 5172.45 - 200 days EMA

Strong Resistence level at: 5360.70 - Set on Oct 28, 2011

Strong Resistence level at: 5633.95 - Set on Jul 22, 2011

Strong Resistence level at: 5884.70 - Set on Apr 28, 2011

Strong Resistence level at: 6134.50 - Set on Dec 31, 2010

Strong Resistence level at: 6274.30 - Set on Jan 04, 2008

Strong Resistence level at: 6312.45 - Set on Nov 05, 2010 (Double Top of Jan 04, 2008)

Next Support Levels:

Minor support level at 4907.89 set by 50 days EMA

Strong support level at 4718.00 set on Feb 05, 2010

Strong support level at 4639.10 set on Nov 24, 2011

Minor Support level at 4531.15 set on Dec 20, 2011

Strong support level at 4003.90 set on Jul 10, 2009

Strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

Strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on Jan 28, 2012

|

|