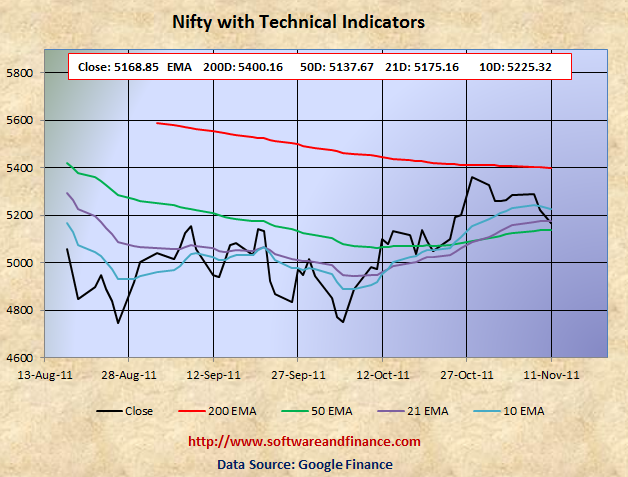

Nifty Weekly Forecast From Nov 14, 2011 - Hold your Short Position (Expected Trading Range: 4747 - 5225)

Nov 11, 2011 - Nifty Closed today at 5168.85 which is about 115 points down (2.19%) from the last week close of 5284.20 on Nov 04, 2011. Nifty was trading in between 5304.25 and 5142.25 which is about the swing of 162 points.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Last Week Analysis - EU anxiety triggered huge volatility again

Nifty went down by 2.19% last week. As per my last week forecast, Market started moving down with EU anxiety triggered selling pressure again. Go long on Indian T-Bills and INR. With respect to US long term treasury prices, TLT closed today at 115.65 with a volatile trading week. currently it is looking for direction. US treasury is too early to buy and too late to short. US treasuries (Ticker: TLT) would bottom near 100 - 103.

Note: US Interest Rate Bottom retesting will happen again in the coming months.

Last Week Low: 5142.25

Last Week High: 5304.25

Nifty technical levels suggest clear betting on shorting the market now.

If you are conservative investors, then exit from your long positions whenever there is a rally and hold currency or indian T-Bills. The key support level for Nifty is 5100, 4960, 4800 and 4747. The key resistance level is 5400.0, which is very much unlikely we will reach and go beyond this level.

Nifty might experience a double dip in Indian Market along with world market correction in the long term (about 2 years). With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

For Speculators and Intraday Players - Short the Market with stop loss or long on long dated OTM Put options

Nifty might open with gap up on monday morning, but it may loose the early gains as the week progresses.

1. Buy long dated (OTM) put option - at least one month expiry time.

2. Short the market with stop loss order

3. Short the market with long call option (Hedging)

Note: OTM - means Outside the money.

Technical Indicators

10 days EMA: 5225.32

21 days EMA: 5175.16

50 days EMA: 5137.67

200 days EMA: 5400.16

Next Resistance Levels:

Strong Resistence level at: 5400.16 - 200 days EMA

Next Support Levels:

Minor support level at 5137.67 set by 50 days EMA

Minor support level at 4940.95 set on Sep 13, 2011

Strong support level at 4806.75 set on May 25, 2010

Strong support level at 4747.80 set on aUG 26, 2011

Strong support level at 4718.00 set on Feb 05, 2010

Strong support level at 4003.90 set on Jul 10, 2009

Strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

Strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on Nov 12, 2011

|

|