Nifty Weekly Forecast Starting Sep 12, 2011 - Market to be highly volatile and range bound trading

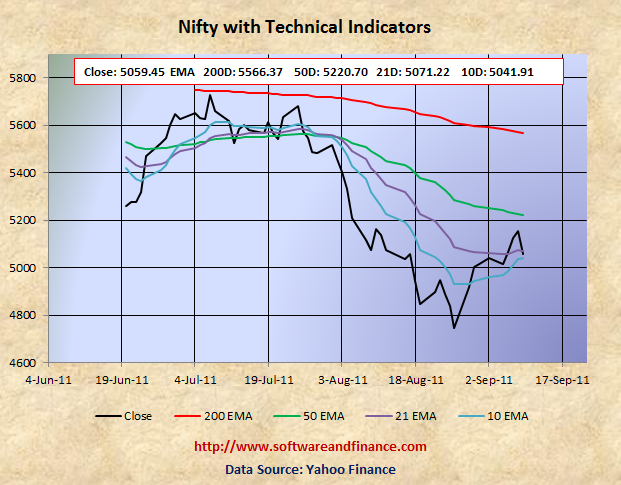

Sep 09, 2011 - Nifty Closed today at 5059.45 which is about 20 points up from the last week close of 5040.0 on Sep 02, 2011. Even though weekly gain is almost flat, Nifty experienced a huge rally in the begining of the week and followed by a sell off on Friday. Nifty was trading in between 4942.90 and 5169.25 which is about the swing of 226 points.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Last Week Analysis - Euro Zone Fears and US Jobs Market with stop loss orders triggered sell off on Friday

Market rallied strongly in the begining of the week due to the oversold conditions and the strong support level has been tested consistantly.

Last Week Low: 4942.90 (Refer to the strong support level 4800)

Last Week High: 5169.25

Nifty technical levels suggest to "hold/Liquidate" your existing long posistions.

Long term investors need to take break from taking long positions. If you are conservative and if you are on the profit side on your long position, you can liquidate a portion of your long positions and hold cuurency or indian T-Bills. Market will swing in either direction and look for direction this week. The key resistance level for Nifty is 5250 and the key support level for Nifty is 4960 and 4800.

Euro Zone fear of possible Greece Default and disappointment outlook from US Fed Chairman Ben S. Bernanke triggered a huge sell off on Nifty. As the market rallied significantly, the intra-day traders taking long positions will always have a stop loss order. When sell off accelerated, stop loss orders started triggering and had a domino effect of other trader stop loss orders.

Nifty might experience a double dip in Indian Market along with world market correction in the long term (about 2 years). With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

For Speculators and Intraday Players - Bet on volatility (Option Strangle)

Market is ready for wild swing in either direction. Hedge your positions or use stop loss order.

1. Buy 1X times of (OTM) put options and 1X time of (OTM) call option - known as option strangle.

Note: OTM - means Outside the money.

Technical Indicators

10 days EMA: 5041.91

21 days EMA: 5071.22

50 days EMA: 5220.70

200 days EMA: 5566.37

Next Resistance Levels:

Resistence level at: 5071.22 - 21 days EMA

Resistence level at: 5225.80 set on Feb 10, 2011 and Jun 20, 2011

Resistence level at: 5220.70 - 50 days EMA

Resistence level at: 5566.37 - 200 days EMA

Next Support Levels:

Minor support level at 5041.91 set by 10 days EMA

Strong support level at 4806.75 set on May 25, 2010

Strong support level at 4718.00 set on Feb 05, 2010

Strong support level at 4003.90 set on Jul 10, 2009

Strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

Strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on Sep 10, 2011

|

|