Nifty June 22, 2011 INR (Rupees) and Indian Government Bonds are the safe heavens

June 22, 2011 - Nifty Closed today at 5278.30 which is down by 5.07% for month to date (compared to May 31st 2011 Close of 5560.15).

With reference to my earlier update, I have mentioned about the rangebound trading and support levels - minor support level at 5225.80 set on Feb 10, 2011. Currently Nifty is trying to hold on its minor support level of 5225.80.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Rupees and Government Bonds are the safe heavens

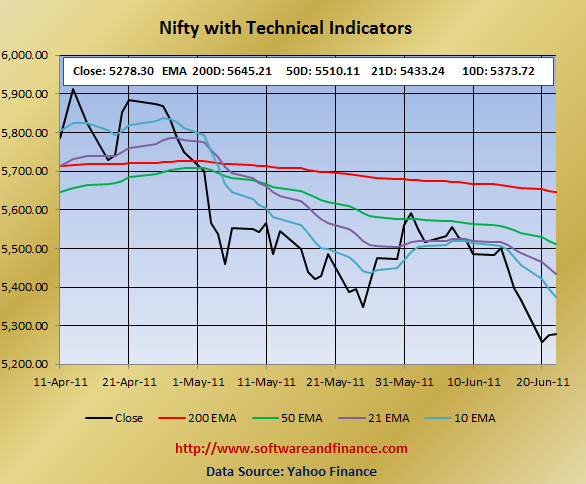

With the recent collapse of Nifty, the technical levels strongly suggest to take bearish pattern. Look at the following chart and Nifty clearly broke the strong support level of 5402.40 and all moving averages - 200 days EMA, 50 days EMA, 21 days EMA and 10 days EMA.

In the current market situation, only Indian Rupees and Indian Government bonds are the safe heavens. Note that Government Bond yields might shoot up further so that you need to start buying government bond from this level and do not complete buying of bonds at current price levels.

It is definitely not a good time to invest in Gold, Silver, Stock, Mutual Fund (with stock holdings) and real estate. RBI is likely to increase the interest rate, we need to wait for couple of months to get a clear picture for long term investment.

Only if you are day/short term trader, you can bet on the market with volatility. Meaning you have to bet on either direction because powerful short term rebound on Nifty is also likely even the technical levels are bearish.

If you are a long term risky player in the market, then you can initiate short position and accumulate short position gradually in the coming weeks. You can not expect return in the short term.

If you are a long term conservative investors, then you have to switch your investment strategy and move on the Fixed Income Securities - Govt. Bonds, Fixed Deposit, etc.

Nifty is good to STRONG BUY for conservative investors only it encounters a deep correction which I expect it to go all the way down to 4800 which was set on Feb and May 2010. There might be chance for double dip in Indian Market along with world market correction. With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

Technical Indicators

10 days EMA: 5373.72

21 days EMA: 5433.24

50 days EMA: 5510.11

200 days EMA: 5645.21

Next Resistance Levels:

Resistence level at: 5645.21 - 200 days EMA

Resistence level at: 5510.11 - 50 days EMA

Resistence level at: 5433.24 - 21 days EMA

Resistence level at: 5402.40 - set on Aug 31 2010

Next Support Levels:

minor support level at 5225.80 set on Feb 10, 2011

strong support level at 4806.75 set on May 25, 2010

strong support level at 4718.00 set on Feb 05, 2010

strong support level at 4003.90 set on Jul 10, 2009

strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on Jun 22, 2011

|

|