Stock Market - Home Prices will continue to go up?

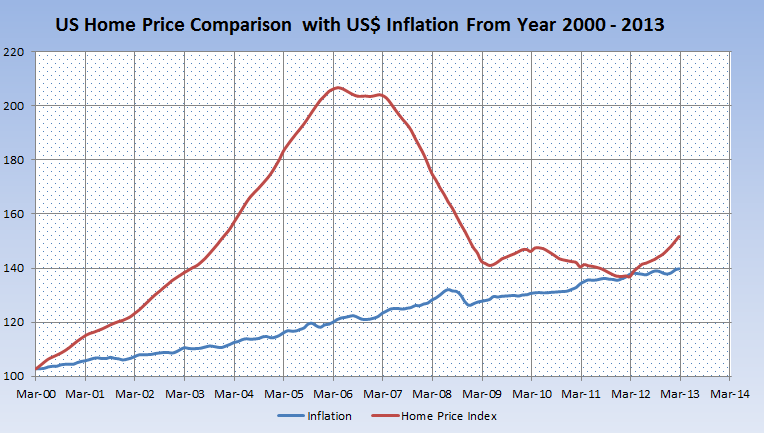

As per data from S&P Case Shiller Index released on May 28, 2013, the 20 city composite index for seasonably adjusted reached at 151.71 which is closer to January 2004 level before the housing bubble.

The good news in housing market is we have touched the bottom in March 2012 if we compare to inflation history starting from year 2000.

Since the mortgage interest rate for 30 years fixed crossed above 4% for the first time since the expectation of Fed may slowdown its bond buying programme. No matter what Fed has to do this, but is the question of time.

The home prices went up so fast only in high demand area like down town, school district. If we compare to the March 2006 peak, there are still over 10 million mortgages having negative equity. When banks will get the comfort zone of managing the number of mortgages with negative equity, then home price will get its peak. Meaning the mortgages having negative equity are getting default, banks should be in a position to manage its balance sheet and continue to do the business with out Fed support.

So Fed wants the US banks and lending institution to protect well as well as they do not want banks getting nationalized. Still we are down by around 25% from the April 2006 peak on home prices. But we may not reach that peak directly in one shot. But still there are good chances that home prices can rally by another 10-15% from current level with in the next 6 month and then go down by 10% in order to corrext with inflation by end of next year (18 months from now).

But to reach the peak what we have seen in April 2006, we have to wait about 4-5 years.

It is too late to buy and still it is a good time if you are buying with only 10% or 20% down payment. But if you are a 100% cash buyer, you can wait until the interest rate reaches around 6-7%.

Data Sources:

http://www.federalreserve.gov/monetarypolicy/openmarket.htm

http://www.standardandpoors.com/indices/main/en/us

http://www.bls.gov