Sell Indian Rupees to Buy US Dollars because of deflation rather inflation

Due to the expectation of increasing inflation in US, people are dumping the dollars and move on to other currencies. As of now, do we have inflation so far in the past two years? No. USA has only deflation in the last two years. From August 2008 to August 2010, the inflation rate is Negative (!) -0.35%, that represents only deflation.

Then why people are dumping dollars? Because of the Fed announcement on Quantitative Easing (QE) leads to think that will increase inflation in USA. But the contrary statement is true. Market moves in the direction by expecting that US inflation will surge. Even if it surges, the USD is fully priced in for that compared other currencies. Fed will apply QE based on need. Already 30 year treasury is at record low. If people are dumping long dated treasuries, then it might apply QE.

Another fact why people are dumping dollar is as it yields very low compared to other currencies. Increasing inflation will also push up the interest rate on that currency.

USD is going to surge like anything by surprising many people because of increased negative divergence. This would happen very soon than later.

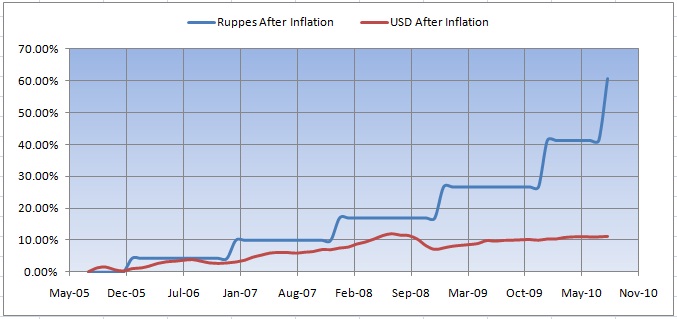

The following is the comparison chart of inflation between USD and INR for the last 5 years. Inflation in USD is just 11.16% from August 2005 to August 2010 where as in INR it is 60.77% in the same duration.

In August 2005, the conversation rate USDINR is around 43.6 and today at 44.70. The conversation rate wise, there is no big difference. I would recommend selling INR and buy USD to take advantage as I expect the conversion rate USDINR will spike above 50-55.

Sources:

http://www.bls.gov

http://www.rbi.org.in/Scripts/PublicationsView.aspx?id=9545

|

|