Gold - When is the Right Time to buy Gold?

Historically Gold is considered as international currency and safe heaven as it will not loose its value like currency. From investment perspective, when people are panic over greenback or euro or rupees, then they will switch to Gold. Majority of portfolio managers will have gold as one of their position as it helps them for liquidity when they are in margin calls.

Excellent Gold buying opportunities will not lost more than a couple of weeks, perhaps days. If we miss it, then we may have to wait for years, even sometimes decades to get gold with good bargained price. As gold prices will not get corrected easily as people will almost never loose their confidence in gold and many people will think gold price can continue to go higher.

Let's analyze the couple of factors which indicates a good time to buy gold. Gold has a very complex relationship with world major currencies, treasuries, stock market, inflation or deflation and hence can not be mapped with one factor correlation.

- Fundamental analysis with currency Inflation/Deflation

- Technical analysis - Wait for 200 DMA to be broken

- Gold Price down by 25-30% from its most recent high.

- Gold / XAU ratio

- Physical Gold Buying in India

Historical Evaluation of Currency Inflation Data versus Gold Prices are the first key factor to determine how much gold is overvalued or undervalued at present. Analysis should be reasonably good. I have given here a wrong analysis and correct analysis. This is just to fool the investor by playing with the historical data.

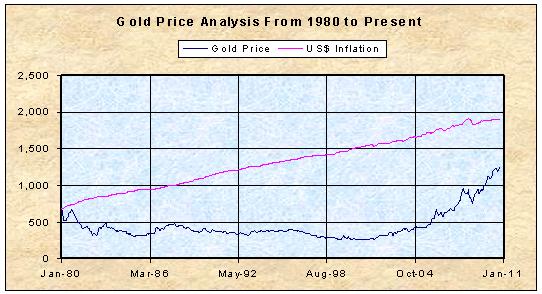

Wrong Analysis Proving that Gold Can Surge Higher to US$1903.53 per ounce

The following is the Historical Comparison of Gold Price Versus US Dollar Inflation since year 1980 to Present. In January 1980, Gold was trading at 678.00 US$per ounce. By applying inflation for the US$worth 678.00 in 1980, the current value would be 1903.53. Gold is deeply undervalued for decades and now its doing a catch up rally by moving towards 1900.

Data Sources: http://www.gold.org and http://www.bls.gov

Even though there is nothing wrong with historical gold price data and inflation data, this is a 100% perfect wrong analysis. This kind of articles are just to fool the novice investors around the world. The reason is the beginning of the analysis taken place from January 1980, when Gold was trading at its peak of the bubble it was undergoing from January 1979. From January 1979 to January 1980, Gold price Was up by close to 200%. Gold is not fairly priced in Jan 1980. When we do a historical analysis, we have to take the starting point where it is fairly priced and no bubble at that point.

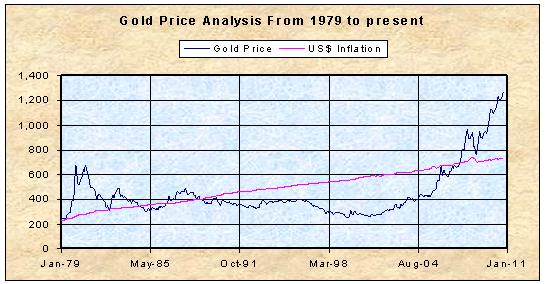

Correct Analysis Proving that Gold Correction is Imminent towards US$727.00 per ounce

The following is the Historical Comparison of Gold Price Versus US Dollar Inflation since year 1979 to Present. In year 1979, Gold was trading at 227.00 US$per ounce. By applying inflation for the US$worth 227.00 in 1979, the current value would be 727.00. Gold is overvalued significantly and now the gold price correction will take us towards 727.

Gold is currently trading at 1384.00 US$as of December 23rd 2010. Even the inflation adjusted gold price suggests that the fair value of gold would be just 727.00 US$per ounce. It is unlikely to see this level in the short run. When the gold price goes below 950.00 US$ per ounce, which is approximately 30% down the peak, would be a nice to time to buy in the short term.

Technical analysis - It provides the precise timing as gold futures are traded on the exchanges and prices every second. When 200 days moving average is broken, we can expect a good sell off that can take the gold price to the next support level.

Evaluating from Recent High - Psychologically when the gold prices are down by more than 25% to 30%, many knowledgeable investors will jump into accumulating gold into their portfolio.

Gold / XAU Ratio - XAU traded in Philadelphia exchanges consisting of 17 precious metal mining companies like Barrick, Newmont, Goldcorp, etc. Low readings of Gold to XAU ratio can signal gold buying opportunities.

physical gold buying - India is leading in physical gold buying compared all other countries. When there is major festivals like Diwali, Pongal, Akshaya Tritiya and marriage season in Thai Month, Indians are eager to buy physical gold. This is the season we may have to avoid gold buying as it will be overvalued compared to other timings.

Short Gold and Silver - With the current market conditions, as of 23 Dec 2010, ProShares UltraShort Gold (GLL) closed at 29.57 and ProShares UltraShort Silver (ZSL) closed at 11.00. Both GLL and ZSL are good to buy from this level.

Posted on Dec 27, 2010

|

|